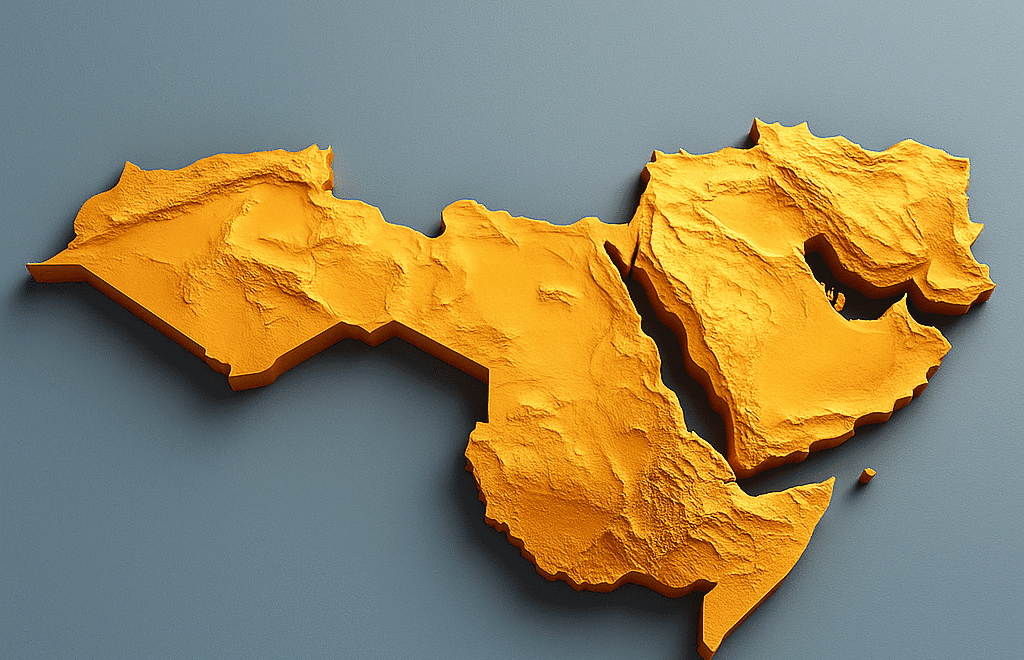

The Middle East private equity industry stands at a pivotal moment. With valuations reaching $19.7 billion in 2024 and projected to surge to $35.5 billion by 2033, the region presents compelling opportunities for strategic investors willing to navigate its unique complexities. Behind these promising figures lies a nuanced reality that demands tactical expertise and operational excellence (IMARC Group, Middle East Private Equity Market Size & Forecast to 2033).

The New Economics of MENA Private Equity: Key Facts and Strategic Shifts

Saudi Arabia now leads MENA private equity, capturing 41% of all regional deals in 2023 and generating about $4 billion in transaction value. This reflects a 66% compound annual growth rate from 2019 to 2023, fundamentally reshaping the investment landscape (ArabNews.pk;Magnitt Saudi Arabia Private Equity Report).

- Deal Structure Evolution: Growth capital investments have surged to 71% of all transactions, surpassing buyouts, which now account for just 29%. This demonstrates a maturing market where investors favor supporting expansion strategies over traditional financial engineering (Bloomberg).

- Massive Capital Inflows: Global private capital is expanding rapidly, with market size projected to grow from $18 trillion in 2024 to $29 trillion by 2029. Institutional and sovereign wealth funds, particularly from the Middle East, are at the forefront of this growth, and nearly 80% of regional investors intend to increase PE allocations in 2025 ( A&O Shearman & Sterling, Global Private Markets Spotlight: Middle East 2025).

Source: Preqin, S&P Global, Evercore, EY 2024 Secondary Market Review ( February 2025 )

Complicating Factors:

- Regulation: Rapid growth has introduced complications. Regulatory frameworks continue evolving, creating both opportunities and challenges for institutional investors. The Kingdom’s Capital Market Authority and Ministry of Investment have implemented comprehensive reforms, yet navigating these shifting compliance landscapes requires deep local expertise and sustained commitment.

- Market Concentration: Market concentration presents another layer of complexity. Sovereign wealth funds like Saudi Arabia’s Public Investment Fund and Abu Dhabi’s ADQ wield substantial resources, hold outsized influence, intensifying both partnership and competitive pressures that foreign investors must navigate.

- Macroeconomic Pressure: Rising global interest rates and regional tensions led to a 24% drop in MENA private equity deal volume from 2023 to 2024, pushing investors toward more selective strategies and lengthier due diligence (MiddleEastBriefing).

- Exit Liquidity: Exit liquidity remains a persistent challenge despite improving IPO markets. Many investors face extended holding periods, with secondary markets still developing depth and sophistication. This dynamic has profound implications for fund structuring and return expectations.

Operational Realities on the Ground

Successful private equity investment in MENA needs to overcome distinctive operational issues that differ from developed markets. Companies tend to conduct operations at limited sizes, with high local market focus and management teams lacking experience in managing bigger, more sophisticated operations.

The service economy is concentrated in key urban agglomerations, subjecting scalability to geographic limitations. Classically oriented operating issues especially labor management and compliance with regulations require investors to build significant operating capabilities in addition to financial engineering skills.

Cultural and governance elements add further layers of complexity. Most companies are family-held or founder-run, and investors need to develop sophisticated stakeholder management and governance succession plans. Success requires not just capital but cultural expertise and deep understanding and building long-term relationships.

Source: EY Private Equity Pulse (Q1 2025)

The Vision 2030 Investment Thesis

Saudi Arabia’s Vision 2030 has structurally transformed the investment ecosystem, creating unprecedented opportunities across multiple sectors. Education, healthcare, housing, retail, and hospitality have emerged as particularly attractive targets, driven by massive government-sponsored infrastructure development and demographic shifts.

The Vision 2030 framework extends beyond conventional diversification plays. It represents a comprehensive economic transformation creating entirely new market categories while significantly expanding existing ones. Private equity investors aligning their strategies with these mega-trends can capture sustained tailwinds potentially generating attractive returns over extended periods.

Government incentives for non-oil sector development have created favorable conditions for private equity deployment, with exit multiples reflecting the substantial growth potential embedded in this economic transformation. The convergence of robust government support, demographic expansion, and infrastructure investment creates a compelling value creation environment (Ministry of Investment Saudi Arabia (MISA), Vision 2030 Investment Framework 2025 update).

Structural Innovations in Fund Management

Evolving market conditions have driven significant innovations in fund structures and investment approaches. Co-investment opportunities have gained particular traction, with investors seeking to reduce fees while maintaining greater portfolio control. Co-investment assets have grown 20-25% annually since 2020, exceeding $2.5 trillion globally, with the Middle East as a key adopter (Bain & Company, Global Private Equity Report 2024).

Traditional fee structures face increasing pressure, with fund managers offering customized arrangements and innovative vehicles such as separately managed accounts and secondary market solutions. These structural developments reflect investor demands for enhanced transparency and alignment of interests.

Environmental, social, and governance factor integration has gained prominence, driven by regulatory requirements and investor preferences. Successful fund managers are embedding ESG frameworks into their investment processes while maintaining focus on financial returns.

Technology and Sustainability as Value Drivers

The intersection of digital transformation and sustainability initiatives creates exceptional value creation opportunities. Artificial intelligence, fintech, renewable energy, and digital infrastructure investments align with both government priorities and market demands, providing multiple expansion avenues for portfolio companies.

Private equity firms specializing in these sectors benefit from supportive regulatory environments, government backing, and accelerating market adoption. The convergence of technological innovation and sustainability focus generates unique investment opportunities with potential for strong returns while advancing economic diversification objectives.

Strategic Imperatives for Success

Successful private equity deployment within MENA requires deviation from typical investment methodologies. Investors must try to build up indigenous local expertise and also establish more patient capital frameworks. They must develop also operational capabilities for navigating complexity and capturing growth potential.

Local partnerships are important in the process of deal sourcing. Exits are executed and they also manage portfolios. Most effective investors combine global best practices as well as use local market intelligence in order to create hybrid models scalable across the region.

Because investors formulate pathway strategies flexible to varying market conditions, exit planning must commence upon initial investment. Better IPO markets, measured buyer interest, and growing secondary markets come together to give more varied exit possibilities than formerly present.

Looking Forward: The Path to Sustainable Returns

As the private equity dynamic in MENA and Saudi Arabia keeps changing, companies have to navigate a tangled mix of regional dynamics, regulatory changes, and international investment norms. Though conventional investment playbooks are in short supply, the region has oversized potential for those who are willing to adjust. At Axial Consulting, we meet the changing private equity environment in the Middle East with an understanding that winning here is not about copying international models , it’s about fitting them to local contexts. We’ve witnessed how regional dynamics from regulatory changes to investor expectations demand careful structuring, more piercing financial planning, and a clever grasp of governance and ESG.

Though every market has its own complexity, the underlying opportunity is straightforward: long-term value creation is in developing structures that equilibrate global norms with local conditions. Our efforts continue to mirror that equilibrium ,one that is increasingly necessary with the accelerating pace of private equity activity in the region.

Sources

- IMARC Group, Middle East Private Equity Market Size & Forecast to 2033 (2024)

- pk

- Bloomberg, MENA Private Equity Market Structure and Deal Trends (2025)

- A&O Shearman & Sterling, Global Private Markets Spotlight: Middle East 2025 (July 2025)

- MiddleEastBriefing, Middle East Private Equity Deal Volume and Macroeconomic Trends (2024)

- Ministry of Investment Saudi Arabia (MISA), Vision 2030 Investment Framework (2025 update)

- Bain & Company, Global Private Equity Report (2024)

- PwC, 2025 TransAct Middle East Report

- McKinsey & Company, Navigating Private Equity in Emerging Markets: MENA Focus (2024)

- Arab News, ESG in Middle East Private Equity (2024)

Authors

Musa Khan Durrani, CFA

Partner

Nida Naguib, CFA, ACCA

Director | Head of Delivery

Umama Alamgir

Junior Consultant | Content Development

Leave a Comment