Central banks worldwide entered 2025 expecting aggressive monetary tightening would return inflation to 2%. Instead, inflation has stubbornly plateaued at 4.5% across major economies, creating a new reality that challenges decades of monetary policy orthodoxy. The Federal Reserve, European Central Bank, and Bank of England have all paused rate hikes, acknowledging that traditional tools may be insufficient against the structural forces now driving persistent inflation.

The limits of monetary policy

Central banks have used conventional tools with little effect. Interest rates remain elevated across major economies, yet inflation refuses to fall below 4.5%. This points to supply side inflation

rather than demand driven overheating. Moreover, monetary policy paths diverge globally: the Fed is cautiously cutting rates with a forecast core inflation of 2.5%, the ECB aggressively eases with deposit rates at 2.75% despite inflation risks from weaker Euro. While emerging markets like Turkey face 45% inflation due to fiscal dominance and currency depreciation (IMF WEO,2025; ECB,2025).

The persistence of inflation at these levels reveals three critical limitations of traditional monetary approaches. First, supply chain disruptions have become structural rather than cyclical, with companies investing in resilience over efficiency. These investments create immediate cost pressures that monetary policy cannot eliminate (Xeneta,2025; KPMG,2025). Second, geopolitical tensions have fragmented global trade networks, forcing costly supply chain diversification (Tradecorp,2025). Third, aging populations in developed economies reduce labor supply and raise service demands driving up wages beyond central bank control (Bridgenext,2025).

Structural forces beyond Central Bank control

U.S. proposals for 60% tariffs on Chinese goods risk adding 0.4 percentage points to U.S. PCE inflation, while retaliatory EU tariffs on Chinese EVs threaten a tariff spiral that raises import costs globally (IMF WEO,2025; WEF,2025).

The most significant driver of persistent inflation lies in what economists call ‘’greenflation’’, the necessary cost increases associated with transitioning to sustainable energy systems. The ESG investing market, projected to reach $167 trillion by 2034 with an 18.82% compound annual growth rate, reflects massive capital reallocation toward clean technologies. While these investments are essential for long term economic stability, they create immediate inflationary pressures as economies rebuild their energy foundations. Green transition costs ripple across sectors, from manufacturing to utilities. Renewable energy infrastructure requires substantial upfront capital expenditures that get passed through to consumers. Manufacturing processes must be redesigned to meet sustainability standards, increasing production costs. These transitions are necessary but inflationary in their early stages.

The demographics of persistent inflation

Aging populations across developed economies create structural inflationary pressure through multiple channels. Declining birth rates reduce future labor supply while increasing demand for healthcare and social services. This demographic shift creates wage pressures in service sectors that are difficult to automate.

Labor market rigidities persist with wage growth of 4-5% year-over-year in the U.S. and Eurozone, largely driven by aging populations and sectoral shortages that entrench services inflation, which constitutes about 60% off core CPI in G7 countries (IMF,2025). Immigration policies that might address labor shortages face political constraints, leaving demographic pressures unaddressed in many economies. These demographic forces interact with climate transition costs to create compound inflationary pressures. Economies must simultaneously invest in new energy systems while supporting aging populations, creating competing demands for resources that drive up costs across multiple sectors (OECD,2023; IMF Fiscal Monitor,2024).

Political pressures and policy constraints

Central banks face unprecedented political pressure to balance inflation control with employment and growth objectives. Social tolerance for economic pain has eroded. This constraint limits central banks’ willingness to implement the aggressive tightening that historical precedents suggest might be necessary.

Income inequality has reached levels where broad swaths of population cannot absorb additional economic stress. Housing costs consume unprecedented portions of household budgets, making any further economic tightening politically unsustainable. Middle income households in advanced economies face 6-8% food inflation, while emerging markets like Argentina and Egypt have rationed energy imports to stabilize currencies, cutting GDP growth by 2-3 points (OECD,2025; IMF,2025). The 4.5% inflation rate represents an implicit compromise between price stability objectives and political feasibility (Binder,2021; ECB Working Paper, 2023; IDEAS,2021).

Investments implications for new normal

The persistence of 4.5% inflation rate creates significant implications for investment strategies. Investor demand for inflation linked assets surged 30% in early 2025, with gold prices reaching all time high and private equity pivoting to infrastructure as real asset hedges. Meanwhile, emerging

markets saw $120 billion in bond outflows amid strong dollar and inflation risks (Deutsche Bank,2025; Market Reports,2025).

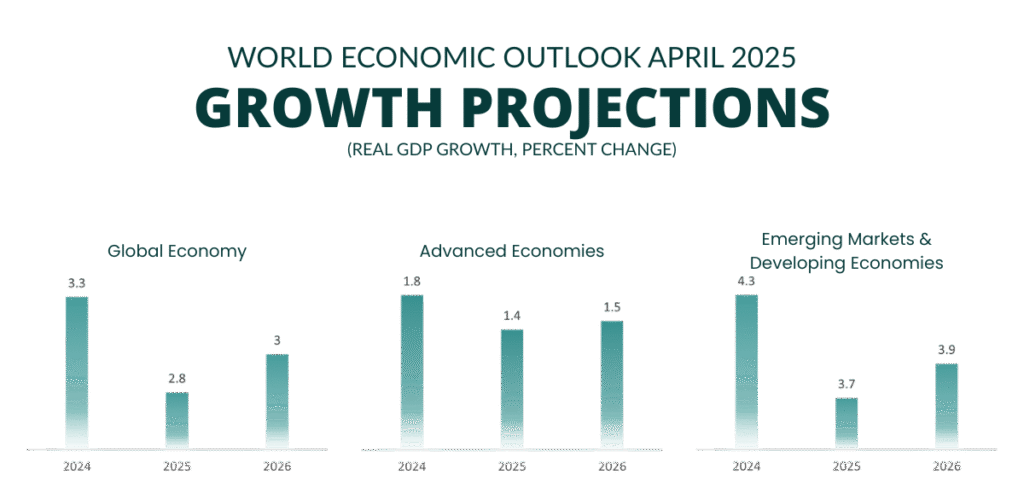

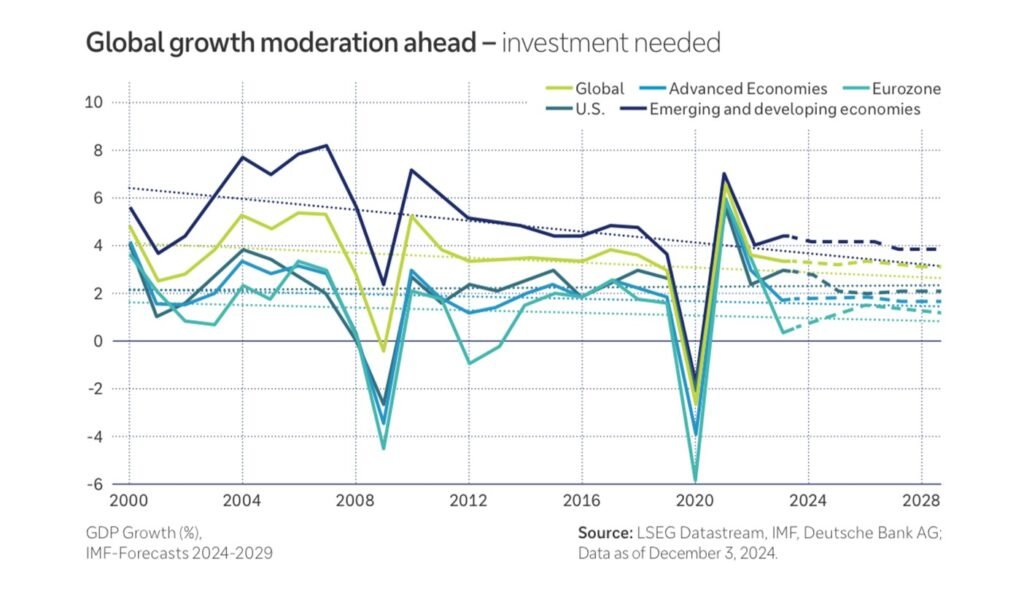

At the same time, global growth continues to decelerate, especially in advanced economies, adding urgency to long term investment shifts.

Traditional fixed income securities become less attractive in sustained higher inflation environments, driving capital toward assets that provide inflation protection. Real estate, commodities, and inflation protected securities gain relative attractiveness. Renewable energy projects generate inflation adjusted returns through long term power purchase agreements. Companies with strong ESG profiles increasingly demonstrate superior pricing power in inflationary environments. Sustainable business practices often create competitive moats that allow for price increases without losing market share.

The path forward

At Axial Consulting, we recognise that the 4.5% inflation environment represents a new economic reality rather than a temporary aberration. Deutsche Bank argues that the 2010s’ low inflation were an anomaly, and structural forces such as AI driven capital expenditure and increased defense spending are likely to keep inflation above 3% through 2030, prompting calls for flexible inflation targets ranging from 2-4% (Deutsche Bank,2025).

Central banks will likely adjust their targets upward, acknowledging that structural forces require acceptance of higher baseline inflation rates. This adjustment represents pragmatic recognition of economic constraints rather than policy failure. The investment opportunities in this environment favor companies and assets that thrive in sustained higher inflation periods.

ESG focused investments increasingly provide not just ethical benefits but practical inflation protection. The transition to sustainable economic ecosystems, while initially inflationary, creates long-term value for investors who position appropriately.

The question isn’t whether central banks can restore 2% inflation, structural forces make this increasingly unlikely. Instead, the question is how investors, companies, and policymakers adapt to an environment where 4.5% inflation becomes the new baseline. Those who adjust their strategies accordingly will find opportunities for value creation even as others struggle with this new reality.

The era of ultra-low inflation may be ending, but the era of sustainable, resilient economic growth is just beginning.

Sources

- ● IMF, World Economic Outlook,2025

- ● World Bank, Global Economic Prospects, 2025

- ● Morgan Stanley, Global Economic Outlook Midyear,2025

- ● World Economic Forum, Chief Economists Look Ahead to a more Bifurcated world of Tariffs and Tensions,January 2025

- ● EY, Global Economic Outlook, January 2025

- ● IMF, Fiscal Monitor,2024

- ● European Central Bank(ECB), Working Paper No.2726,2022

- ● Network For Greening the Financial System(NGFS), The Green Transition and The Macroeconomy,2024

- ● Tradecorp,Supply Chain Disruptions in 2025 and What to Look Out For

- ● Bridgenext,The 2025 Guide to Supply Chain Disruption Management

- ● ECB Working Paper No.3049,2023

- ● IDEAS/RePEc,Political Pressure on Central Banks,2021

- ● Afrouzi H.,Halac,M.,Rogoff,K.,&Yared, P.,Changing Central Bank Pressure and Inflation, Brookings Institution, 2024

- ● Deutsche Bank, Why Inflation Risks are Still Rising in 2025

- ● AXA Investment Managers, the Good, the Bad, the Opportunities,Green Bonds in 2025

Authors

Musa Khan Durrani, CFA

Partner

Nida Naguib, CFA, ACCA

Director | Head of Delivery

Umama Alamgir

Junior Consultant | Content Development

Leave a Comment